Accumulated depreciation calculator

Now let discuss how to calculate accumulated depreciation. Since its an expense you record it as a debit.

Depreciation Formula Examples With Excel Template

Annually you record the amount of depreciation by making journal entries.

. The term residual value is also often used to refer to the value of an asset after depreciation. Depreciation expense vs. Depreciation expense is the amount you deduct on your tax return.

A general depreciation system uses the declining-balance. Accumulated depreciation is an intermediary balance of the reduction of in the value. The value we get after following the above straight-line method of depreciation steps is the depreciation expense which is deducted from the income statement every year until the assets useful life.

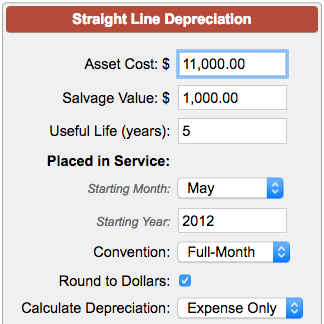

We have to find the straight line depreciation method using the first method. In the first year of use the depreciation will be 400 1000 x 40. MACRS ACRS 150 200 Declining Balance Straight-Line Sum-of-the-Years-Digits Vehicles Amortization Units of Production and Non-Depreciating asset methods are all available.

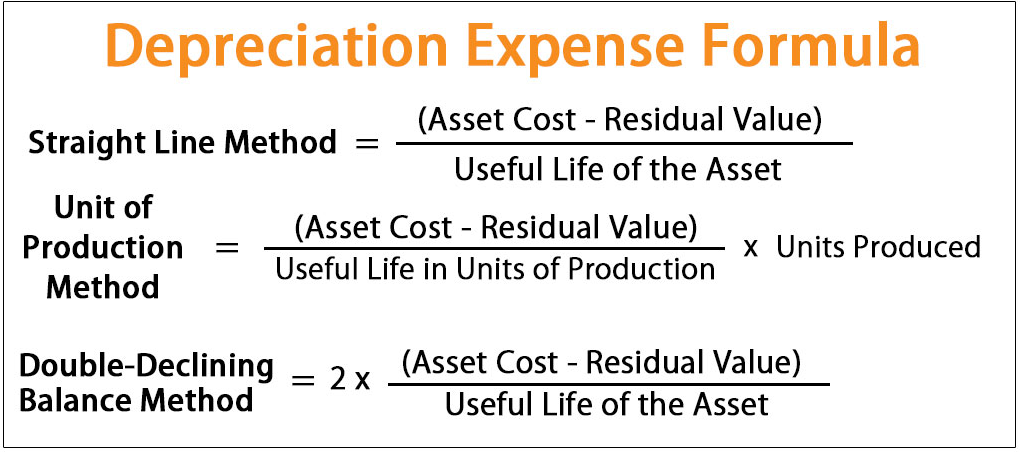

The term of the lease and the average accumulated miles in a year. A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the Double Declining Balance MethodUse this calculator for example for depreciation rates entered as 15 for 150 175 for 175 2 for 200 3 for 300 etc. This calculator is designed as a quick ready reckoner for Balance Sheet calculations.

Fixed assets represent long-term assets used by companies and businesses in the generation of revenues and profits. Mathematically we can apply values in the below. Leasehold improvements 2.

Accumulated Depreciation TOTAL Fixed Assets. Star Software Fixed Asset Depreciation provides for Book Tax Alternate ACE and Other State depreciation. Since most of these assets require high-value investments accounting standards require companies not to charge the cost of these assets in a single.

Follow the next steps to create a depreciation schedule. Double Declining Balance Method. Multiply the depreciation rate by the cost of the asset minus the salvage cost.

Calculate the depreciation rate ie 1useful life. Accumulated depreciation is the total amount youve subtracted from the value of the asset. Accumulated depreciation on 31 December 2019 is equal to the opening balance amount of USD400000 plus depreciation charge during the year amount USD40000.

Includes formulas example depreciation schedule and partial year calculations. Figure out the assets accumulated depreciation at the end of the last reporting period. Value at the end of the year per each line is the figure obtained by subtracting the amortization from the start booking figure.

Cr_Accumulated depreciation 40000 BS Total accumulated depreciation expenses at the end of 31 December 2019 is USD440000. Book value is found by deducting the accumulated depreciation from the cost of the asset. Calculator for depreciation combining declining balance and straight line methods.

The annual amount is calculated as. Accumulated depreciation for the first year is equals the depreciation for that year from year two accumulated depreciation is said to be as the depreciation expense for previous year and every year up until the current year. Straight-line depreciation Original value Salvage ValueUseful Life.

Accumulated Depreciation Book Value Year End Depreciation Method Used 2010. The formula for this type of depreciation is as follows. Also try our calculator for accumulated depreciation cost to figure out the accumulated depreciation balance sheet.

There are several types of fixed assets that companies use including property plant and equipment. Assume a business buys a machine for INR 1crore with a useful life of 25 years and a salvage value of INR 10 lakhs. Accumulated depreciation is known as a contra account because it has a balance.

Depreciation is a procedure for subtracting the reduced value during an assets usable life. What Method Can I Use To Depreciate Property. Enter the relevant values for your Assets and Liabilities.

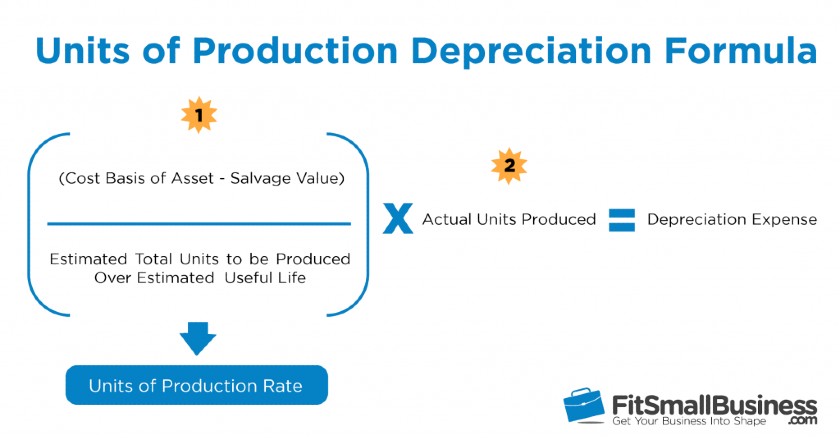

General Depreciation System - GDS. Total Depreciation Per Unit Depreciation Total number of Units Produced. The most commonly used modified accelerated cost recovery system MACRS for calculating depreciation.

Free lease calculator to find the monthly payment or effective interest rate as well as interest cost of a lease. For the second year the depreciable cost is now 600 1000 - 400 depreciation from the previous year and the annual depreciation will be 240 600 x 40. The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book value at the end of the year and the depreciation method used in calculating.

The depreciation of property begins when it is placed into service for use in an income producing activity. SLM depreciation 10000000 100000025. Finally the formula for depreciation can be derived by dividing the difference between the asset cost step 1 and the accumulated depreciation step 8 by the useful life of the asset step 3 which is then multiplied by 2 as shown below.

Use this calculator to calculate an accelerated depreciation of an asset for a specified period. Depreciation value is the amount the asset gets depreciated by each period of usage from its entire life. Assets are depreciated for their entire life allowing printing of past current and.

For more information or to do. This accumulated depreciation calculator tracks depreciation as it is used and accumulated. Specifically these debit the Depreciation Expense account and credit Accumulated Depreciation a contra-asset that diminishes the assets book value.

The depreciation of property ends when the basis or cost of the property is completely used up. One characteristic that is. For the third year the depreciable cost becomes 360 with a depreciation of 144 and so on.

Depreciation recapture is the USA Internal Revenue Service procedure for collecting income tax on a gain realized by a taxpayer when the taxpayer disposes of an asset that had previously provided an offset to ordinary income for the taxpayer through depreciationIn other words because the IRS allows a taxpayer to deduct the depreciation of an asset from the taxpayers.

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Definition Formula Calculation

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation Expense Calculator Flash Sales 51 Off Www Ingeniovirtual Com

Depreciation Expense Calculator Store 53 Off Sportsregras Com

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Definition Formula Calculation

Depreciation Rate Calculator Flash Sales 56 Off Www Ingeniovirtual Com

Depreciation Calculator Property Car Nerd Counter

Depreciation Expense Calculator Flash Sales 51 Off Www Ingeniovirtual Com

Accumulated Depreciation Definition Formula Calculation

Depreciation Expense Calculator Factory Sale 50 Off Www Ingeniovirtual Com

Depreciation Expense Calculator Factory Sale 50 Off Www Ingeniovirtual Com

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Definition Formula Calculation

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Double Declining Balance Depreciation Calculator

Komentar

Posting Komentar